Key Innovation Issues for the Time Ahead – Part 2- Valutrics

In addition to the still highly topical issues, outlined in part 1, I’d like to raise another four points which I personally foresee key for innovation management in the time to come – making no claim to completeness:

In addition to the still highly topical issues, outlined in part 1, I’d like to raise another four points which I personally foresee key for innovation management in the time to come – making no claim to completeness:

Organizational Ambidexterity

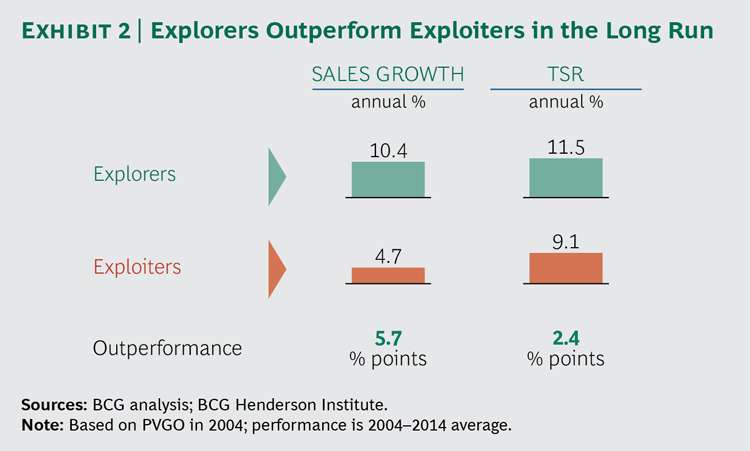

As you can see from previous posts, I’ve been passionately advocating the importance of organizational ambidexterity for a couple of years now. From my own practice and observations as well as from recent discussions with other innovators in my local and global communities, it’s obvious to me that this issue is increasingly understood and becomes a major organizational requirement. It turns out more essential than ever for corporations to find ways how they can balance their innovation portfolio and to evaluate which structures, strategies and resources they have to put in place. Although, this is highly individual to each company, there may be some common cornerstones – such as the “Three Horizons” concept – structuring this way. Research confirms: development of exploration in parallel to exploitation capabilities proves to be mandatory for established companies in order to compete successfully and sustainably. Streamlining and simplifying existing businesses can be a major lever for resourcing important exploration initiatives. Note: Explorers outperform exploiters in the long run!

Co-Innovation and startup engagement

One way for established organizations to strengthen exploration is by developing internal capabilities in order to overcome their inherent inertia. Another way is to “outsource” exploration through external engagement with startups. Thus, organizations acknowledge their inertia and focus on their exploitative strengths, rather than on their explorative weaknesses. Steve Blank and Evangelos Simoudis point out that todays’s RD departments are not capable of accomplishing the exploration work anymore. On top of this, from an incumbents’ point of view, there are legitimate reasons for rejecting a new technology. If it underperforms, there is no business case for adopting it unless there is improvement. Moreover, if the innovation is truly different, then the incumbent would have to overhaul its systems and operations to adopt it. That means high integration costs – and another reason to be wary of new innovation. But incumbents would be willing to make changes if a new technology proves to be truly disruptive and the long-term benefits are worth it. Therefore, more and more companies turn to establishing innovation centers in order to take a “wait-and-see” approach, rather than to predict the future: they connect with startups and increase their stakes in those whose fresh ideas turn out to be taking off.

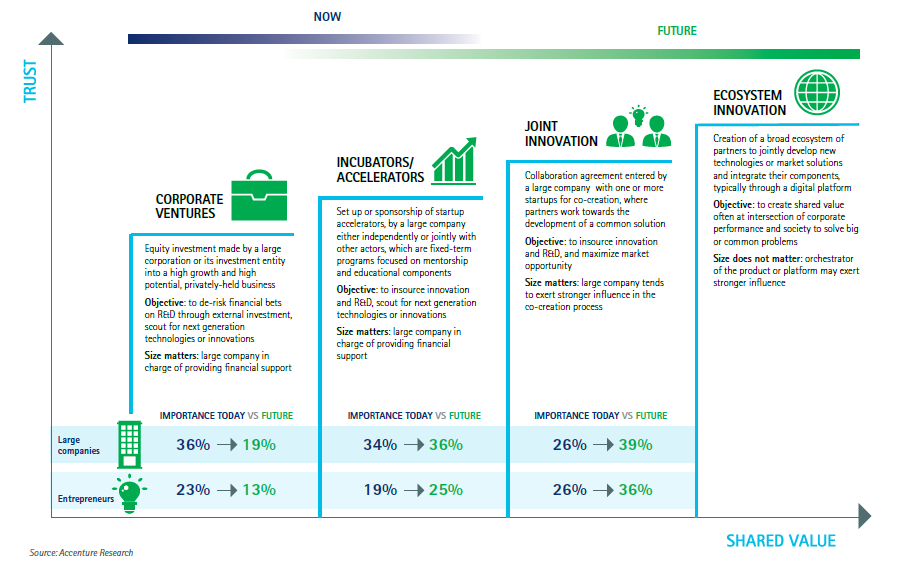

Most companies will continue to favor a “safer” approach in the time ahead, even while facing disruption. This suggests, this path to explorative innovation may be more appropriate for them. A key issue will remain how to establish co-innovation best and how to leverage new ventures in order to attain strategic or innovation goals. What’s more, proven benefits are also on the side of startups: corporate-backed startups tend to exhibit higher innovation rates compared to those backed by traditional, independent VCs.

Research confirms large companies as well as entrepreneurs to rate the importance of collaborative forms of innovation higher for the future. Further, the ROI (return on investment) of collaborative innovation was found to have been increasing recently. In light of rising connectedness, thinking in complementarities and co-creating in ecosystems with small and large partners (as discussed above) will increasingly take hold. One recent example for strategic complementarity is the announced partnership between GM and Lyft.

Digital Transformation

Digital Transformation – the use of digital technology to radically improve performance or reach of companies – affects every industry sooner or later. It will become a hotbed for innovation in 2016 and the coming years. On the one hand, it requires tailored digital strategies for companies, entailing technology-enabled, but highly customer-centered innovation. On the other hand, digitalization poses challenging requirements on organizations to become capable of going about these innovations, becoming truly user-centered and picking up the needed speed for the digital age. Although it should be obvious to companies that they jeopardize their existence if they don’t pursue digitalization with the required focus and speed, there seems to be a severe deviation between target and actual. BCG comments:

(…) it appears that even within the technology sector, many companies are not getting the message; on average, only about a third of executives project big data and mobile will have a significant impact on innovation in their industries over the next three to five years. Even fewer are actually investing in them. (…)

Consumers, who have been educated by the likes of Apple, Amazon, and Google in the possibilities of digital technologies, have moved quickly up the adoption curve. Digital technologies make their lives easier and better, and they want more digital – and mobile – interaction from the companies and other organizations that they do business with. (…) Companies are proving slower to adopt digital. (…)

As of the first quarter of 2014, 30 percent of Fortune 500 companies did not have a mobile app, and less than half had a mobile website. Most companies are not targeting mobile products and capabilities in their innovation efforts. The B2B marketplace has also been slow to catch on. Digital and mobile are only gradually making their presence felt there. (…)

We would expect to see the most intensive innovation focus in big data, given all the attention that has been devoted to the ability of digital data and advanced analytics to generate new products, markets, and revenue streams. Indeed, BCG research shows that big data leaders generate 12 percent higher revenues than those who do not experiment with big data. They are also twice as likely as their peers (81 percent compared with 41 percent) to credit big data with making them more innovative. (…) Still, three-quarters of our respondents said that their companies are not targeting big data in their innovation programs.

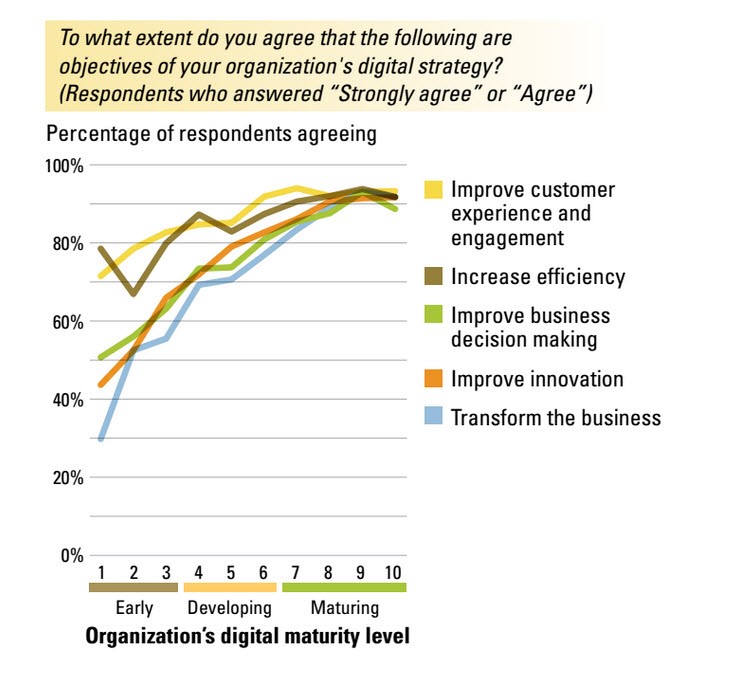

These results seem to complement findings of a recent study, conducted by MIT SMR and Deloitte. One major finding was, that organizations can be categorized in different digital maturity and awareness levels. Depending on the maturity level, distinct objectives and priorities are reported (see figure below). “Early”, digitally immature organizations (mostly without any digital strategy) focus on cautious, operationally-driven point investments for improving customer experience and engagement, as well as for increasing efficiency first. They aim at capitalizing on digitalization to advance their existing businesses. Mature organizations (following a dedicated digital strategy), in contrast, also rate bolder objectives, such as improving innovation and transforming the business, as prioritized objectives. From this, it becomes obvious that a certain organizational readiness seems mandatory in order to make use of digital technologies for innovation, let alone transforming business models.

What are critial conditions and factors contributing to digital innovation success in sufficiently mature companies? I’d like to highlight a couple of important ones – it’s where research intersects with my personal experience:

- Digital strategy: Developing and pursuing a digital strategy drives digital maturity. Without a coherent set of vision, priorities and objectives, an organization will hardly be aware and prepared to tap into the transformative power of new technologies.

- Dedicated labs or teams: Companies with dedicated cross-company labs or innovation teams are more than twice as likely to have launched at least one major digital innovation within the last 3 years.

- C-Suite mandate and sponsorship: Of those with labs or teams with direct C-level sponsorship, 100% have shipped significant digital products, indicating a strong C-level buy-in does help get more major initiatives out the door.

- Two-speed organization: A two-speed IT operating model decouples the digital business and traditional business with its legacy systems in order to cope with distinct pace and innovation speeds for each of both. This can be considered a special case of organizational ambidexterity in the digital transformation context. Setting up an independent digital organization is a good way to get things moving quickly, but only if the digital organization collaborates closely with the rest of the business and is properly aligned with the back-end IT developers.

Accelerated shift towards customer experience innovation

The coming years, probably decades, will be determined by two major shifts. First: Services already account for over 60% of the GDP of 35 of the top 40 economies in the world. Business activities, both B2B and B2C, tend to continuously shift towards differentiating services as digital technologies enable new business models (such as sharing services or product-as-a-service, cue: circular economy) as well as make products comparable and accessible on a global scale – and therefore more and more a commodity. Second: Accelerating deployment of novel digital technologies become the norm on the side of companies, but even faster on the side of customers. 75% of all digital data is now created by consumers, much of it via handheld devices. The increasing use of mobile devices results in “always on”, more demanding and powerful customers. Further, ongoing digitization is increasing the number and variety of customer touchpoints. That makes clear: we have been entering a new age of customers and services.

This combination of shifts implies some mandatory changes for companies. They have to

- make their business customer-centered, rather than product-centered

- serve customer needs in the context of life events, rather than selling products

- shift from customizing products to individualized experiences

- optimize the customer journey across all physical and digital touchpoints

Which impact does all this have on innovation considerations? To me, it definitely indicates innovation management will have to focus strongly on the customer experience (CX) by adjusting or renewing business models and adressing one-to-one engagement. Well-suited approaches, such a experience design or jobs-to-be-done help innovation initiatives putting the customer in the center. However, most companies are not yet adept in innovating truly customer-centered and need to build these capabilities in order to stay competitive. Forrester argues:

In the Age of the Customer, consumers are in control of their interactions with businesses. Inundated by endless sources of information, customers expect ready access to content that is personally relevant in the context of what they are doing and accessible anytime, anywhere, and in the format and on the device of their choosing. Attracting, winning, and retaining customers in this environment requires a concerted effort from across the business: The organizational structure, company culture, and business technology must all be aligned in service of the customers, in the spirit of delivering them exactly what they want. For this reason, digital and customer experience strategies are inexorably linked. Most every change that organizations make to aid in their digital transformation is also in pursuit of a better customer experience, whether directly or indirectly.

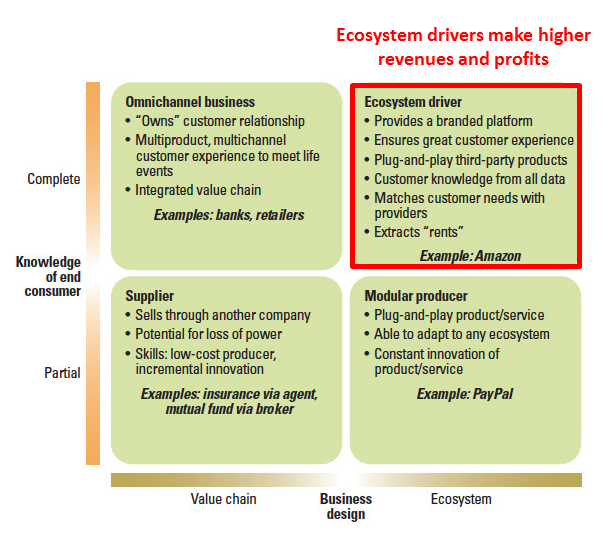

Gartner predicts that by 2018, more than 50 percent of organizations will implement significant business model changes in their efforts to improve customer experience. Research further confirms CX innovators to outperform their peers. The number one lesson to be learned for the digital era: companies that “own” the end customers, serve their contextual needs and provide a superior customer experience by means of appropriate – mostly platform-based – buiness models are going to win the customer’s trust and take the lead!

Adapted from: http://sloanreview.mit.edu/article/thriving-in-an-increasingly-digital-ecosystem/

Takeaway

Which key innovation issues should companies and innovators have on their agenda in order to stay ahead in the time to come? Some advisory points in a nutshell:

- Rather than using broad-brush approaches, align your innovation activities with integrative concepts that allow to differentiate but complement distinct innovation contexts. Once again: one size never fits all!

- Develop business model innovation capabilities and provide for essential preconditions – first and foremost: CEO sponsorship and autonomous organizational space.

- We are moving towards a co-creative platform economy. Therefore, evaluate whether to orchestrate your own platform or just participate in an other’s. Either way: be part or be out!

- Develop a culture of experimentation for exploring new businesses, but also for strengthening existing businesses. You will get one of the most critical success factors for innovation in reward: speed.

- Make sure your organization operates ambidextrously. Invest sufficient resources in explorative innovation because explorers outperform exploiters in the long run.

- Innovation is not accomplished solely by one company any more. Reach out to the right partners for co-innovation. Engage particularly with startups if you prefer to play it “safe” but yet intend to drive radical or disruptive initiatives.

- Prior to tapping into the huge innovation potential of digital transformation, build your company’s strategic readiness by conceiving the digital “big picture”. How to go about digital innovation? Setting up a dedicated digital unit, mandated and sponsored by the C-suite might be a promising start.

- A new age of customers and services is on the rise. Shift your thinking and offers from customized products to individualized and contextualized services. Customer experience innovation will be the emerging battleground!