Supply chain finance platforms might provide ‘win-win’- Valutrics

The need for supply chain finance

Supply chain finance upends the traditional means of bankrolling a supply chain in that it lets manufacturers and suppliers work together to pursue payment and delivery terms that consider both sides’ unique roles.

For one, globalization has changed how products are manufactured. Parts arrive from suppliers spread across many countries, and a manufacturer’s finished product often targets a global customer base. But manufacturers also typically need time to create a larger product and ship it — more time than when a supplier expects payment. When a manufacturer pays a supplier faster than it can turn a profit on its own product, it is incurring debt and tying up cash flow.

As an example of this imbalance, Tom Roberts, a senior vice president of the supply chain finance platform PrimeRevenue, points to how a heavy equipment manufacturer sometimes can’t turn around a product faster than the industry standard of 80 days payable outstanding. Meanwhile, a supplier will send a bill as soon as its product is received and expect payment within 30 days, meaning the manufacturer will, until it makes money on its product, provide the supplier with a loan for 50 days or more, he said. “It’s not the best way to convert cash,” Roberts added.

On the other end, suppliers typically don’t want to accept longer payment terms to accommodate a manufacturer’s longer production and sales schedule. Suppliers that agree to lengthy payment schedules will similarly feel the strain of cash and might resort to high-interest loans.

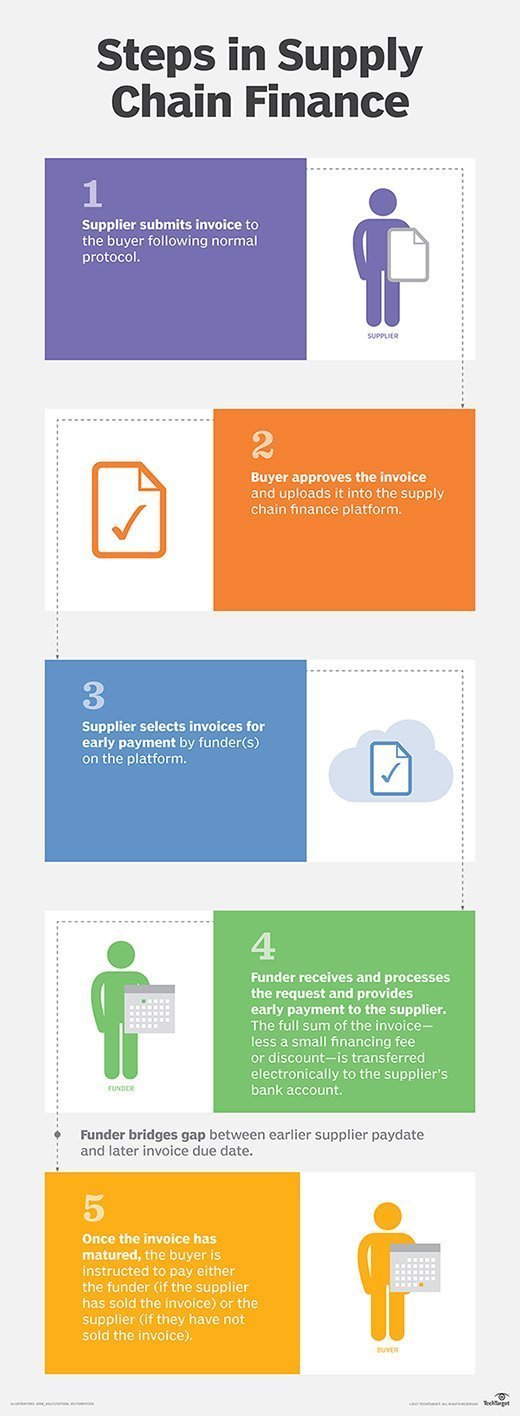

Supply chain finance aims to pay suppliers when they need to be paid, while taking manufacturers off the hook — albeit temporarily — from paying before they’re ready. There are various forms of supply chain finance, but the one favored in manufacturing focuses on post-invoice transactions. Using a supply chain finance platform, a manufacturer and supplier come to terms and select a lender. After a manufacturer approves and submits the supplier’s invoice to the lender, the lender pays the supplier on an agreed date or earlier, minus a small discount for the manufacturer. The manufacturer, meanwhile, has a longer window of time to pay the lender.

Roberts and others call the arrangement a “win-win” for both sides. A supplier can get paid within days, while a manufacturer can wait as long as 120 days — sometimes longer — before having to meet its financial obligation.